LOCATE A PUBLIC ADJUSTER

LOCATE A PUBLIC ADJUSTER

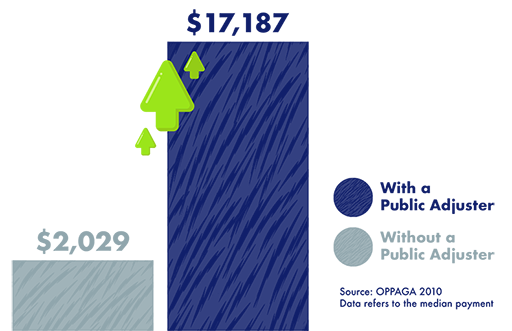

Public Adjusters are licensed insurance professionals trained to interpret your policy, scope and estimate losses, submit your claim, and negotiate with your insurance company to ensure maximum settlement amounts.

A sloppy inspection from your assigned insurance adjuster can cause your claim to be denied or undervalued.

Tiger Adjusters® offers no-cost property inspections utilizing the latest technology to capture a full and accurate account of all damages.

Be honest — did you read the fine print of your insurance policy?

When property damage occurs, our team reviews your policy and provides expert advice on a recommended course of action for your claim.

We create a detailed loss estimate and file your claim plus complete all the required documentation.

It’s tedious work but when it comes to the value of your claim, the dollars are in the details!

Tiger Adjusters® fully represents you in negotiations with your insurance company. We review the carrier’s inspection report, estimate, and settlement offer to evaluate if you are being paid fairly.

If not, we fight for funds for all covered damage so that you can repair and restore your property.

Learned about Tiger Adjusters® through a plumber I hired for emergency water damage work to my property. They saved me so much time and effort negotiating with my insurance on my behalf and brought in their own inspectors to help get me the best claim return possible. I trusted them to get my claim approved and they followed through! Definitely would recommend and will be using them in the future whenever I need to file a claim.

Rachael Hannah | Philadelphia, PA

Tremendously helpful both in ensuring we were adequately compensated as part of our insurance claim as well as navigating the complexities of dealing with an insurance carrier. I would highly recommend them to anyone currently struggling with a claim.

Garrett Barnes | Houston, TX

Tiger Adjusters® has several licensed Public Adjuster offices across the country (with more locations coming soon). Get help with your property insurance claim in Florida, Texas, Georgia and Philadelphia.

Most homeowners have never read their insurance policy in its entirety. When a loss occurs, the stress of making a property damage claim without a clear understanding of coverage can be overwhelming.

Fortunately, our Public Adjusters are ready to make sure your insurance company plays fair and will fight for the protection you paid for with your premiums. We believe your time and energy are better spent getting your life back to normal for you and your family. Trust our team to take the lead on your claim and get you a fair settlement.

When a weather disaster or catastrophic event unfolds, damage can impact your bottom line and the ensuing chaos can threaten the viability of your investments and even your passive income.

As an experienced commercial property owner, you know that the likelihood of a loss occurring is high and that each instance requires an urgent response. Having Tiger Adjusters® on speed dial can help safeguard your property portfolio’s value.

Not sure the difference between adjusters?

The biggest variation is who they are accountable to.

Insurance Adjusters work directly for an insurance carrier (such as AllState, Liberty Mutual, StateFarm, etc) as an employee.

Independent Adjusters contract with insurance companies to provide adjusting services as an independent contractor.

Public Adjusters work for the policyholder (you) in settling insurance claims.